Facing a bottleneck in your Embedded Display Project?

Don’t let complex integration or supply chain issues slow your time-to-market. Book a free consultation with the RJY expert team for tailored design and manufacturing support.

NXP’s rise and fall in the RF PA sector reflects the challenges of strategic decision-making during technological iterations. Its foundation was laid in 2015 with the $12 billion acquisition of Freescale (formerly Motorola’s semiconductor division), which provided NXP with deep expertise in LDMOS technology and the Chandler wafer fab in Arizona.

During the peak of 4G deployment (700MHz to 2.6GHz), LDMOS PA was the gold standard for base stations due to its cost-efficiency and stability. NXP captured this window perfectly, becoming a core supplier to global base station manufacturers and securing early-mover advantages in the LTE era.

However, the transition to 5G demanded higher power density and frequency. The commercialization of the C-band (3.5GHz) pushed the industry toward Gallium Nitride on Silicon Carbide (GaN-on-SiC). To maintain its lead, NXP launched the state-of-the-art ECHO 6-inch GaN fab in 2020. Unfortunately, this move could not withstand dual shocks from the market and technology:

Consequently, NXP decided to exit. The ECHO fab is expected to cease GaN production by Q1 2027, ending a dominant chapter in RF history.

NXP’s exit has sent shockwaves through the industry. Equipment manufacturers—spanning base stations to Industrial, Scientific, and Medical (ISM) devices—now face narrowed supplier choices and potential supply interruptions.

To manage the exit, NXP initiated a “Last Time Buy” (LTB) mechanism. This forces customers to purchase up to three years of inventory at once. Combined with previous price hikes—some reportedly as high as 3x—this has placed immense financial and logistics pressure on clients, especially smaller firms with less bargaining power.

Industry experts warn that while production continues until 2027, customers are already initiating urgent “Redesigns” to find reliable alternatives rather than hoarding uncertain inventory. This creates a critical replacement window between now and early 2027.

NXP’s exit is expected to release $150M to $300M in annual market share. While Sumitomo, Macom, and Wolfspeed are vying for this space, it also presents a historic opportunity for Chinese RF PA leaders like Hiwafer (Huatai Electronics).

As the only domestic supplier currently verified in the supply chains of the global top five base station OEMs, Hiwafer’s technical maturity is market-proven:

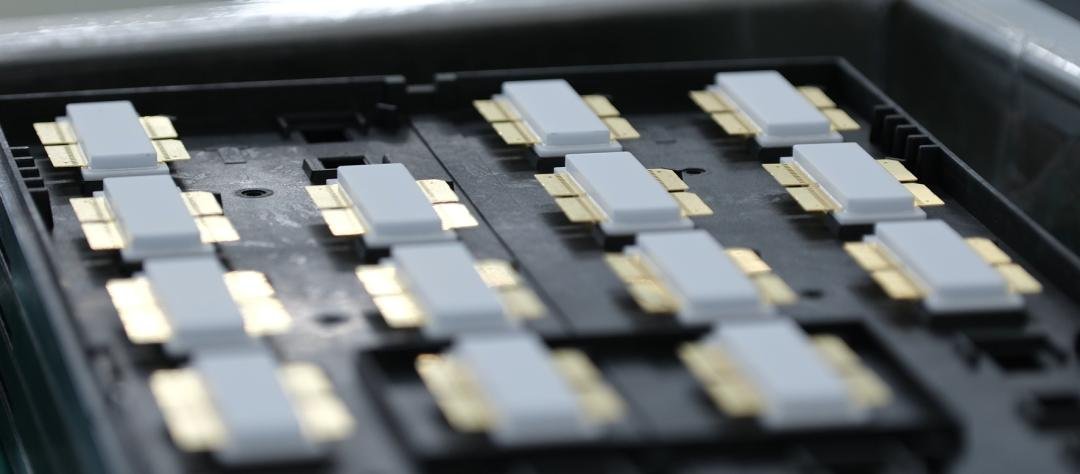

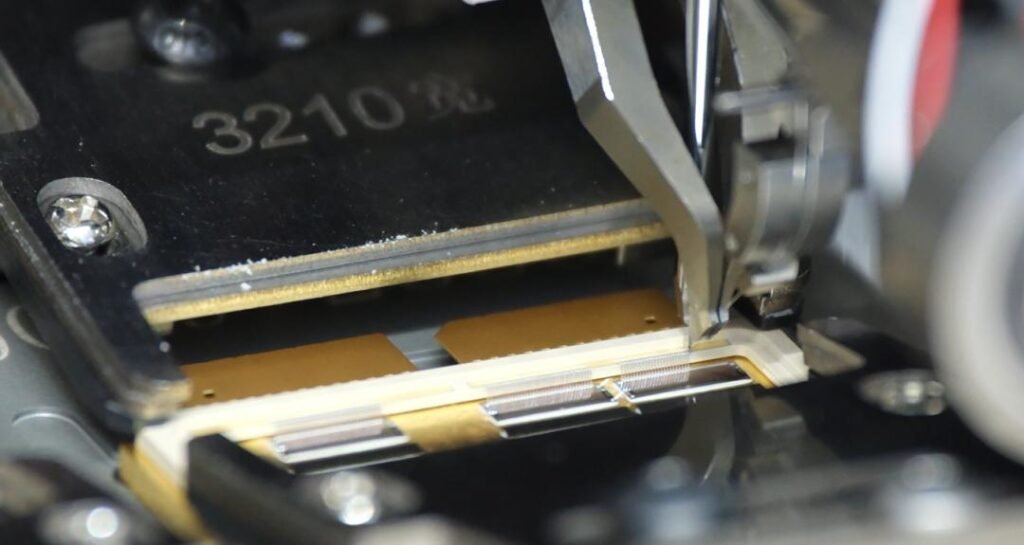

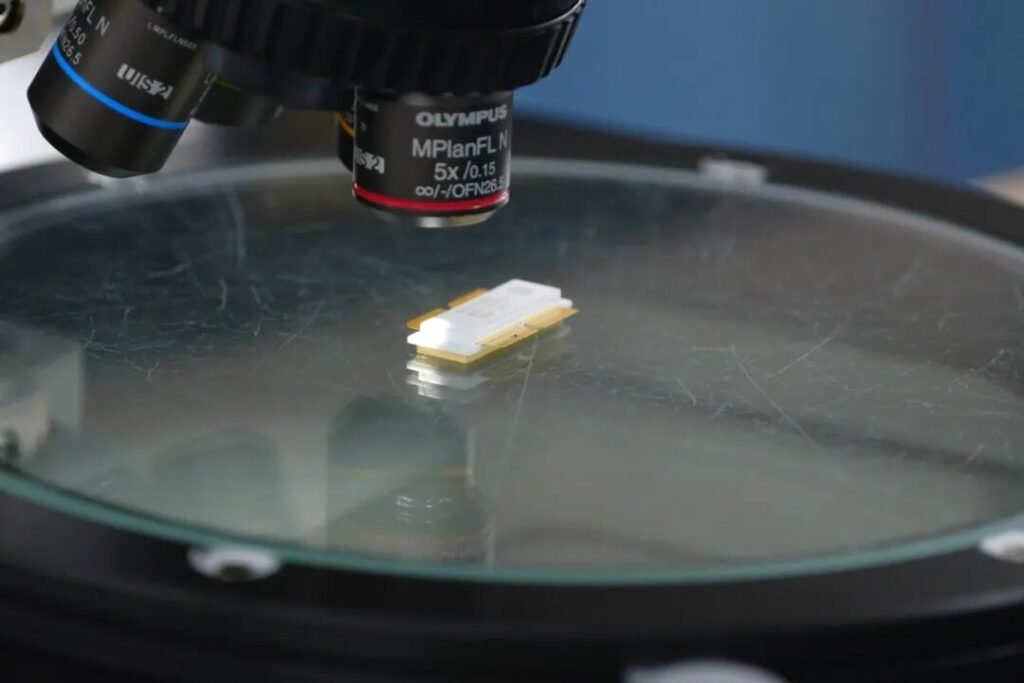

The core of the “New Growth” lies in security and value, not just cost. Hiwafer’s competitive edge is built on its Vertical Integration Strategy: Upstream Materials – Device Design – Foundry Collaboration – In-house Packaging & Testing.

By self-developing critical components like high-performance thermal packaging and adhesives—previously under foreign embargo—Hiwafer has built a closed-loop supply chain. Their dedicated Yaohua Packaging Fab ensures capacity for both large-scale OEM orders and the urgent, customized needs of smaller “long-tail” clients.

Trust is built on performance. Hiwafer has shipped over 350 million RF PA units, with its products featured in benchmark projects like the Xiaomi SU7 automotive intercom. Their LDMOS platform’s consistency has been tested across base stations, ISM networks, and RF power supplies.

For international clients, Hiwafer has aligned with European and American standards (RoHS/REACH) and passed the quality audits of top-tier global telecom giants. To better serve the overseas market—which accounts for over 90% of the $150M-$200M market share released by NXP—Hiwafer has established offices in the Netherlands, Northern Europe, South Korea, and Singapore.

Starting in 2026, the Singapore global headquarters will act as the bridgehead for global expansion, ensuring supply chain security through a “Dual-Cycle” manufacturing footprint (domestic + Southeast Asia).

The exit of NXP is a reminder that agility is survival. For Hiwafer, the peak of 5G infrastructure may have passed, but the industry is entering a phase of technical deepening. New growth drivers like Sub-6GHz n104, 5G-Advanced (5G-A), 6G research, Satellite Communications, and the Low-Altitude Economy are emerging.

이 페이지의 내용을 복원할 수 없습니다.